#Twitter's #Leaked Data of Earning by #Selerity:

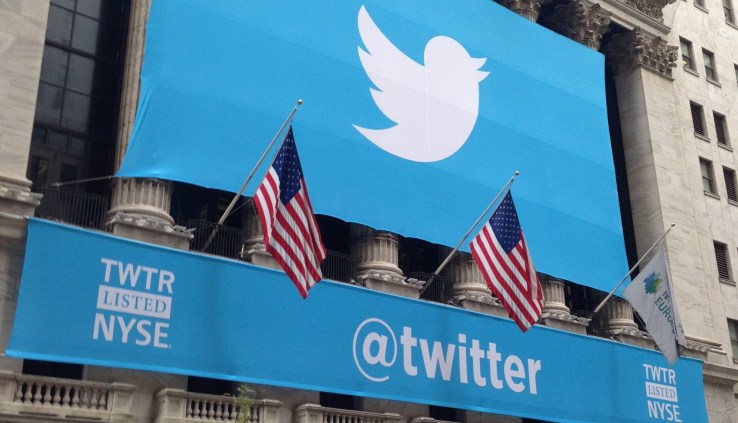

Falling TWTR Temporarily Halted After Results Published Early by Selerity — On Twitter

Twitter Collapses 18% In Wake Of Lackluster Q1 Revenue, User Growth

30 April 2015

Twitter was supposed to be releasing its earning results after market close this afternoon, but financial intelligence firm Selerity published the numbers early.

Where oh where could they have gotten that information? It appeared at first to be a leak, but as Selerity pointed out, the earnings release was already live on Twitter’s investor relations site. (We’re not totally clear on the chronology of events here, but we first saw the numbers thanks to Selerity, and we weren’t the only ones.)

Trading was halted after shares plummeted, but it has since resumed, and TWTR closed more than 20 percent below its price an hour earlier. Why did it take such a hit? Well, after several quarters of solid financials combined with weak user growth, the company’s revenue of $436 million fell short of analyst estimates; guidance was down, too.

Twitter Collapses 18% In Wake Of Lackluster Q1 Revenue, User Growth

In a bizarre leak, Twitter’s first quarter earnings made it onto the Internet — read: Twitter — before the cessation of regular trading, sending the company’s shares sharply lower. Trading was halted for a period.

The company reported revenue of $436 million, an increase of 74 percent on a year-over-year basis. That number missed the company’s own guidance, as well as street estimates that the company would report $456.8 million. Twitter earned $0.07 using adjusted metrics, and lost $0.25 using normal accounting methods (GAAP). The street had expected an adjusted profit of $0.04.

The company’s GAAP net profit fell during the period, compared to the year-ago quarter, expanding from negative $132.3 million, to negative $162.4 million. The company’s GAAP EPS also fell by several cents, to negative $0.25.

So, Twitter beat on profit and missed on revenue. Why the massive drop in its share price? Two answers: Lower guidance for 2015 and user growth that fails to excite.

Guidance

The first of two womps, Twitter put its reduced guidance in its headline:

The company expects that in the current quarter, it will generate revenue of between $470 million and $485 million. The company does not appear to predict that it will be profitable in the period. While the revenue projection does, on a sequential basis, best the first quarter’s record, the street had expected a much higher $538.2 million tally. Twitter’s estimates are miles light.

For the full year, Twitter expects to generate revenue of $2.17 billion to $2.27 billion. The market had expected Twitter to generate $2.37 billion in revenue during the year. Twitter and the street are again distant in terms of their expectations.

Users

Twitter reported that its monthly active user count has reached 302 million, up 18 percent compared to the year-ago quarter, and up from 288 million in the sequentially preceding quarter. The company indicated that it sees 80 percent of its monthly actives as monthly mobile actives.Mobile advertising constituted 89 percent of Twitter’s total ad revenues, which came to $388 million in the quarter.

Twitter has long been judged harshly for user growth that investors have found to be either unremarkable or downright disappointing. Twitter has often beaten expectations on the financial side, but missed on its ability to drive new engagement. Akin to the revenue and cash-flow point, if Twitter can’t grow its user base, it can’t, eventually, make more money. Investors don’t like that much.

During the earnings call, CEO Dick Costolo told investors that during the first 10 days of Periscope’s release, over 1 million people signed in to the app.

Twitter’s GAAP loss of $162 million overshadows its impressive $147 million in internationally sourced revenue, which itself grew 109 percent compared to the year-ago quarter. Twitter shares are down, as it failed again to convince the world that not only can it make a lot of money, but that it can chart a course to a billion users. Twitter: Maybe not as big as was originally anticipated.

---

Today’s $TWTR earnings release was sourced from Twitter’s Investor Relations website https://t.co/QD6138euja. No leak. No hack.

— Selerity (@Selerity) April 28, 2015

---

No comments:

Post a Comment